Forex trading, with its potential for high returns, can be a lucrative endeavor. However, like any financial venture, it carries inherent risks that must be carefully considered before embarking on this trading journey. Understanding these risks is crucial for novice and seasoned traders alike to make informed decisions and manage their exposure to potential losses.

The Dangers of a Volatile Market

Leverage: A Double-Edged Sword

Leverage can amplify your profits, but it can also magnify your losses. When you trade forex with leverage, you’re borrowing money from your broker to increase your position size. This means that even a small price movement can result in a significant loss. For example, if you trade with 100:1 leverage and the price moves against you by 1%, you could lose 100% of your investment.

| Leverage | Price Movement | Potential Loss |

|---|---|---|

| 100:1 | 1% | 100% |

| 50:1 | 2% | 100% |

| 20:1 | 5% | 100% |

Market Volatility: A Constant Threat

The forex market is known for its volatility, which can be both an opportunity and a risk. Unexpected economic events, political developments, and natural disasters can all cause sudden and dramatic price swings. If you’re not careful, these swings can wipe out your profits and even lead to significant losses.

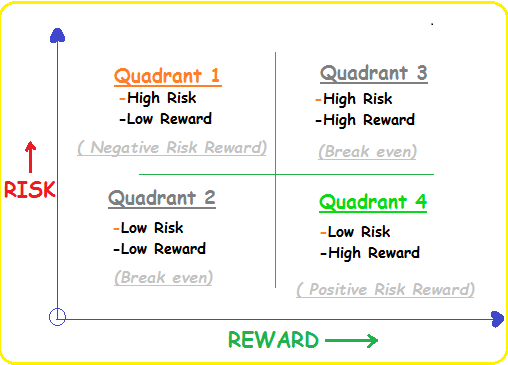

The Importance of Risk Management

Managing your risk is essential for forex trading. It’s important to develop a trading plan that outlines your risk tolerance and your exit strategy. You should also use stop-loss orders to limit your potential losses. By taking steps to manage your risk, you can help protect your capital and increase your chances of success.

| Risk Management Technique | Description |

|---|---|

| Stop-Loss Orders | Automatically close your position when the price reaches a certain level. |

| Position Sizing | Determine the appropriate size of your trades based on your risk tolerance and account balance. |

| Diversification | Spread your investments across multiple currencies to reduce your exposure to any single currency. |

What are the negative effects of forex trading?

High risk of losing money

Forex trading is a high-risk activity, and it is possible to lose all of your invested capital. The currency market is highly volatile, and prices can move quickly and unexpectedly. This volatility can lead to significant losses, especially for inexperienced traders. Forex trading is not a get-rich-quick scheme, and it takes time, effort, and a lot of patience to be successful.

- Leverage can amplify both profits and losses, meaning that even small price movements can result in substantial gains or losses.

- Market volatility can lead to sudden and unexpected price swings, making it difficult to predict market movements.

- Lack of proper risk management can lead to overtrading and excessive losses.

Emotional and psychological impact

Forex trading can be emotionally draining, as it can be stressful and demanding. The constant pressure to make profitable trades can lead to anxiety, frustration, and even depression. It’s important to have a strong mindset and to manage your emotions effectively when trading.

- Emotional trading can lead to impulsive decisions and irrational behavior, which can result in losses.

- Overtrading can be a result of emotional pressure, leading to increased risk and potentially bigger losses.

- Lack of sleep and poor diet can be consequences of stress and anxiety, further impacting your trading performance.

Potential scams and fraudulent activities

The forex market is unfortunately prone to scams and fraudulent activities. There are many fake brokers and trading platforms that prey on unsuspecting traders. It is important to be cautious and to do your research before investing in any forex broker or platform.

- Fake brokers may offer unrealistic returns and use high-pressure sales tactics to entice traders into depositing funds.

- Scams involving fake trading platforms can steal your money and personal information, leaving you with nothing.

- Illegitimate trading signals and advice can be misleading and lead to significant losses.

Is Forex considered high risk?

Yes, Forex is considered high risk. It is a highly leveraged market, meaning that traders can control large positions with a relatively small amount of capital. This leverage amplifies gains, but it also amplifies losses. This means that even small price fluctuations can lead to significant losses. Furthermore, the Forex market is global and operates 24 hours a day, 5 days a week. This means that traders are exposed to market volatility around the clock, making it difficult to predict price movements.

Factors that contribute to the high risk in Forex

- Leverage: Leverage amplifies both gains and losses. Even small price fluctuations can lead to significant losses, especially for inexperienced traders.

- Volatility: The Forex market is highly volatile due to its global nature and the constant flow of news and economic data. This volatility can make it difficult to predict price movements and can lead to sudden and unexpected losses.

- Liquidity risk: While the Forex market is generally considered to be very liquid, there are times when it can become illiquid. This can happen during periods of high volatility or during major economic events. Illiquidity can make it difficult to enter or exit trades at desired prices, leading to potential losses.

Tips for managing risk in Forex

- Use a demo account: Practicing on a demo account allows you to familiarize yourself with the Forex market and test different trading strategies without risking real money.

- Start small: Begin with a small account balance and gradually increase your trading size as you gain experience and confidence.

- Use stop-loss orders: Stop-loss orders are essential for limiting potential losses. They automatically close a trade when the price reaches a predetermined level.

- Manage your risk: Determine a maximum percentage of your account that you are willing to risk on any single trade.

- Diversify your portfolio: Spread your investments across different currency pairs to reduce risk.

- Keep yourself informed: Stay up-to-date on economic news and events that can affect the Forex market.

- Learn from your mistakes: Analyze your trades and learn from your successes and failures.

Is trading on Forex safe?

Is forex trading safe?

The safety of forex trading depends on a number of factors, including your level of experience, your risk tolerance, and the strategies you employ. Forex trading can be highly risky, and it is important to understand the potential risks before you start trading. Forex trading is also highly leveraged, which means that even small price movements can result in significant gains or losses.

Risks of Forex Trading

- Market Volatility: Forex markets are highly volatile, meaning that prices can move quickly and unexpectedly. This can make it difficult to predict price movements and can lead to significant losses.

- Leverage: Forex trading is highly leveraged, which means that you can control a large amount of currency with a relatively small amount of capital. Leverage can amplify your profits, but it can also amplify your losses. This is why it is important to understand the risks of leverage before you start trading.

- Liquidity: Forex markets are generally very liquid, meaning that there are always buyers and sellers. However, liquidity can be limited during certain times, such as during news announcements or economic events. This can make it difficult to enter or exit trades, and can result in losses.

Tips for Safe Forex Trading

- Start with a Demo Account: A demo account allows you to practice trading in a risk-free environment. This will help you to learn the basics of forex trading and to develop your trading strategies.

- Manage Your Risk: One of the most important aspects of safe forex trading is risk management. This includes setting stop-loss orders to limit your potential losses, and diversifying your portfolio to reduce your overall risk.

- Educate Yourself: It is important to understand the basics of forex trading before you start trading. This includes learning about the different types of orders, the various trading strategies, and the different types of risks involved.

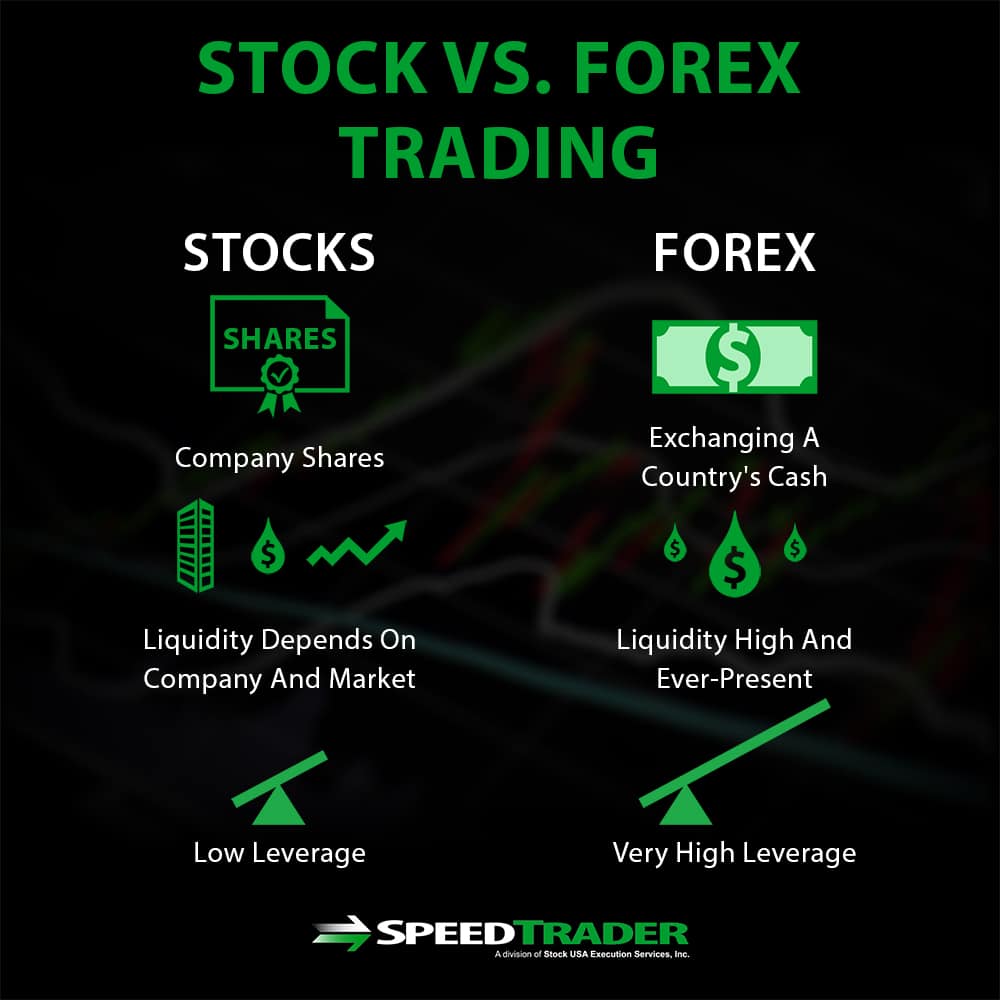

Is Forex Riskier than stocks?

Forex vs. Stocks: A Comparative Risk Analysis

Determining whether Forex or stocks is riskier is a complex question with no definitive answer. Both asset classes carry inherent risks, but the specific risks and their potential impact vary significantly depending on factors such as trading strategy, leverage, and market conditions.

Risk Factors in Forex Trading

Forex trading involves exchanging currencies, which are subject to fluctuations due to various factors, such as:

- Economic events: Global economic events, such as interest rate changes, political instability, and economic data releases, can significantly impact currency valuations.

- Geopolitical factors: Political tensions, wars, and international relations can influence currency exchange rates.

- High leverage: Forex traders can use leverage to magnify their profits, but it also amplifies losses. Using high leverage can lead to substantial losses, even with small price movements.

- 24/5 market: The Forex market operates 24 hours a day, 5 days a week, making it challenging to monitor and manage trades constantly. This can increase the risk of unexpected market movements.

Risk Factors in Stock Trading

Stocks represent ownership in companies, and their value can be affected by various factors, including:

- Company performance: The financial health and profitability of a company directly impact its stock price. Negative news or poor earnings reports can lead to stock price declines.

- Market sentiment: Overall market sentiment, investor confidence, and economic conditions can influence stock valuations.

- Industry trends: Changes in industry regulations, technological advancements, and competitive pressures can affect the performance of individual stocks.

- Economic factors: Macroeconomic factors such as inflation, interest rates, and economic growth can impact the stock market as a whole.

Frequently Asked Questions

What are the risks of losing money?

What are the risks associated with leverage?

Leverage is a double-edged sword in forex trading. While it can amplify your potential profits, it also significantly increases your risk of substantial losses. When you use leverage, you borrow money from your broker to increase your trading position size.

What are the risks of fraudulent or unregulated brokers?

What are the risks of trading on your own without proper knowledge?